Craig’s Closing Grain Market Comments

January 08, 2015

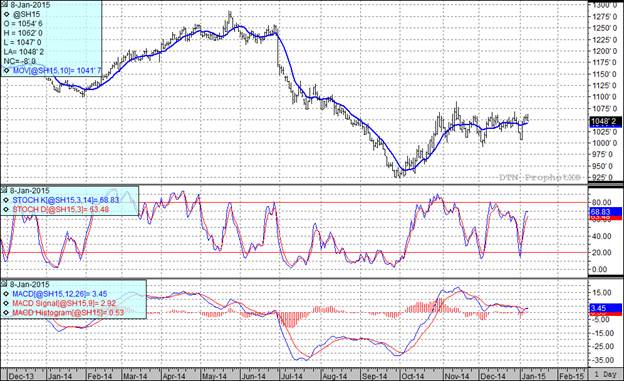

Corn:

Weekly export sales this morning came out at 15.3 million bushels which was below the low end of trade expectations. Looking at this from the long term picture we see that corn sales need to average 19 million bushels per week with export shipments needing to clock in at 35 million bushels weekly to achieve the current USDA projection for the year.

Much of the trades attention is focused on the January 12 USDA report and while my crystal ball is no better than anyone else’s it is worth noting that if we look at record yielding years since 1993 we have seen the corn yield reported in the January report increase over the December projection four out of the five years.

One other thing to keep an eye on, although it didn’t seem to make much of an impact today was that today was the first day of a five day time period in which the funds are re-allocating how they are invested. For corn that means we will see some additional fund selling due to re-allocation in each of the next four trading days.

All three of my technical indicators are still bearish as we continue to trade in a sideways pattern. If we look at the Fibonacci retracement numbers we see support in the March futures at $3.84 with more significant support at $3.64. On the up side the $4.17 area looks formidable and of course the gap looms at $4.26 (dashed blue line on the following chart).

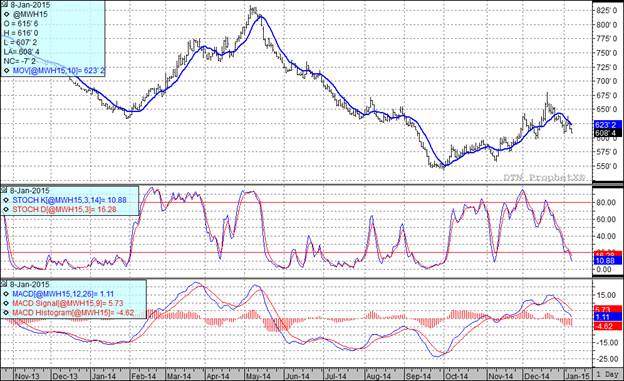

Soybean:

The weekly export sales for beans were actually better than expected, coming in at 33.5 million bushels. For soybeans to achieve the current USDA projection we only need to have weekly sales of 6 million bushels while weekly export inspections need to run at a pace of 20 million bushels per week. With the delayed South American crop this year that should be very achievable.

Heading into the report on Monday it is worth noting that in record yield years we have seen the national average yield number increase over the December projection in four out of five years. Not bad odds.

We will be getting fresh South American numbers tomorrow when Conab comes out with updated soybean production numbers. Their last report had soybeans pegged at 95.8 MMT. We are hearing of some weather concerns in the northeast growing area of Brazil but at the same time I am seeing reports of greenhouse type conditions in Rio Grande del Sol.

In spite of today’s lower close all three of my indicators are still bullish.

Wheat:

Heading into Monday’s report the conventional wisdom is that we will see them reduce the amount of Russian exports, decrease Australian production by 1 or 2 MMT while increasing exports from the EU, Canada and Argentina.

With 82% of the continental USA reaching temperatures below freezing today one would have thought that we may have seen more “fear of freeze damage” induced rally but that was not the case. The path of least resistance seems lower for wheat sat the present time.

All three of my technical indicators are currently bearish both the Minneapolis and Kansas City March futures.

Top Trending Reads:

- Grain Outlook for 2015

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

- Market Insider from the Farm and Ranch Guide

This data and these comments are provided for information purposes only and are not intended to be used for specific trading strategies. Commodity trading is risky and North Central Farmers Elevator and their affiliates assume no liability for the use of any information contained herein. Although all information is believed to be reliable, we cannot guarantee its accuracy and completeness. Past financial results are not necessarily indicative of future performance. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples.

North Central Farmers Elevator - 12 5th Ave. Ipswich, SD - 605-426-6021.